All Categories

Featured

Table of Contents

Home mortgage insurance policy pays off your home mortgage to the financial institution, while life insurance policy supplies a survivor benefit to your selected recipient for different costs. What makes a home a home? Some would certainly claim that a house is not a home up until it is full of family members and various other liked ones. All life insurance policy strategies are designed to assist fill up monetary gaps that would open if the primary carrier passed away all of a sudden.

This would permit your family to proceed residing in the home you produced with each other. While all life insurance policy plans pay a survivor benefit to the beneficiary cash that can be utilized to pay the home loan there are many various other variables to think about when it comes to choosing the right policy for your needs.

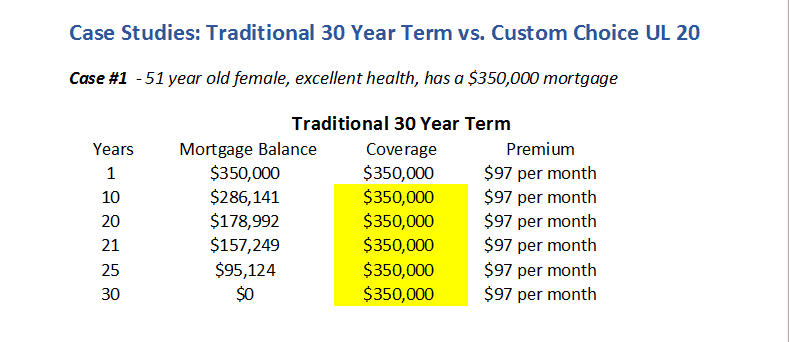

Depending on when you buy a term life policy, it might provide security for the period in your life when you have the most house costs for your family. Many individuals choose term life insurance to correspond with the length of their mortgage payoff.

Consider consulting with an economic representative who can assist you run the numbers and select the right coverage amount for your needs. While entire life and universal life insurance policy can be made use of to assist pay home loan expenditures, lots of people pick term life insurance policy instead due to the fact that it is typically the most inexpensive alternative.

Costs Diehl below at Western & Southern Financial Group and today we're going to speak about a concept called mortgage demands and just how a life insurance policy might play a function with your mortgage. You listened to that right: life insurance coverage and home loans. Why would anybody put life insurance coverage and a home loan into the same sentence?

However what concerning you exactly how are your loved ones secured? Here's where life insurance policy is available in: if a breadwinner were to die a life insurance policy policy might potentially assist loved ones remain in the household residence. mortgage payment protection insurance uk. Life insurance policy pays a prompt survivor benefit as quickly as evidence of death of the guaranteed person is equipped to the insurance coverage business

Is Mortgage Payment Protection The Same As Ppi

And while these earnings can be made use of for anything when it comes to a home loan defense approach, they're made use of to assist keep paying off the mortgage hence enabling the making it through household to continue to be in their home. That's the deal: life insurance coverage and mortgages can coexist and if you're interested in finding out even more regarding just how life insurance policy may play a function in your mortgage strategy, talk to a monetary specialist.

Hey, thanks for viewing today! If you such as this video, please be certain to touch the like switch below and register for this channel. Home mortgage insurance policy is a sort of insurance coverage that safeguards lenders in the occasion that a consumer defaults on their home loan repayments. The lending is designed to reduce the risk to the lender by offering payment for any type of losses if the customer is incapable to repay.

Regular monthly mortgage payments are increased to consist of the expense of PMI.: MIP is a kind of insurance policy needed for some car loans assured by the government, like FHA (Federal Housing Management) fundings. lv mortgage life insurance. It shields the lending institution against losses in situation the debtor defaults on the financing. MIP may be paid in advance at the time of lending closing as a single charge or as part of the consumer's reoccuring monthly home mortgage payments

It does not secure the debtor in case of default but permits customers to acquire a home loan with a lower deposit. Also if you have home mortgage insurance coverage via your bank or home mortgage loan, you can still need life insurance policy. That's due to the fact that financial institution home loan security only provides mortgage benefit, and the beneficiary of that policy is generally the financial institution that would receive the funds.

Usaa Mortgage Protection Insurance

It could aid pay instant expenditures and offer home mortgage defense. It might also assist your liked ones settle debts, cover education and learning expenses and even more. You might even have the ability to change the bank mortgage insurance coverage with one bought from a life insurance policy business, which would allow you choose your beneficiary.

If a borrower were to pass away or shed the ability to hold back steady employment as an example, because of an injury or medical issue MPI could cover the principal and rate of interest on the mortgage. As a home owner with a home mortgage, you require to prepare for the future. Let's take a tough appearance at what home mortgage protection insurance coverage needs to use so you can decide if it makes sense to safeguard protection for yourself and your family.

home owners insurance policy is one of the most costly real estate prices you'll pay monthly. And depending upon where you live, you may be required to purchase added hazard insurance policies to cover dangers like flooding, hurricanes and quakes. Home loan security insurance is a completely various kind of insurance coverage, though.

MPI can assist minimize those problems altogether. When you acquire MPI, your policy might cover the length of your home finance. So, if you have a 15-year set rate home mortgage, your MPI plan can run for 15 years. MPI is occasionally also described as home loan life insurance policy or perhaps mortgage death insurance because it pays an advantage when the policyholder dies, much like standard life insurance policy.

There might be exclusions that avoid beneficiaries from obtaining a payment if the insurance holder were to die by self-destruction (in the initial 2 years) instead than natural reasons or mishap. What if there are numerous debtors on a home car loan?

As we noted, home loan payment security insurance coverage can include unique motorcyclists called that cover chronic or crucial disease. They might likewise supply coverage for serious injuries that stop insurance policy holders from working at complete ability. In these situations, debtors are still alive, yet because of diminished profits, are incapable to make month-to-month home loan repayments completely.

Uk Mortgage Life Insurance

Mortgage protection insurance can cover practically any type of real estate cost you desire. Settle your whole home funding in one go? You can do that. Place down just the minimal monthly payment on your mortgage? Definitely. Make added repayments on your mortgage to build equity and pay back your car loan quicker? That's an option, as well.

When those funds strike your savings account, you can utilize them any way you such as. Spend that money on your month-to-month real estate costs, conserve it for a rainy day or cover other expenses like clinical expenses, cars and truck settlements and tuition. Where MPI can absolutely establish itself in addition to term life insurance policy is with.

As a policyholder, if you choose to increase your home mortgage security insurance policy payout, you can do so in just about any type of quantity you like. Acquisition an MPI plan with living advantage motorcyclists for crucial and chronic disease.

Mortgage Redundancy Insurance

Provided just how useful they can be for families handling challenge, however, it might be worth choosing an insurance policy specialist who focuses on these kinds of plans. In the huge bulk of cases, MPI benefits are paid out to the insurance holder's recipients. They can then invest that cash any kind of means they like.

The choice is yours totally. That is, unless you get a credit report life insurance coverage plan. These insurance intends offer the fatality advantage directly to your lending institution, who would certainly then repay your mortgage. The money would never touch your hands. In fact, however, credit scores life insurance policy is unbelievably uncommon, so you're unlikely to find across it.

It's free, straightforward and secure. Whether home loan life insurance policy is the right plan for you depends primarily on your age and health and wellness. Young home owners with minimal clinical problems will improve quotes and higher insurance coverage choices with term life insurance policy. On the various other hand, if you have extreme health and wellness troubles and won't get term life insurance policy, then home loan life insurance can be a great alternative, because it does not take your health right into account when establishing rates and will offer larger death advantages than several choices.

Some policies connect the fatality advantage to the impressive mortgage principal. This will act similarly to a lowering survivor benefit, but if you repay your home mortgage much faster or slower than anticipated, the policy will certainly mirror that. The survivor benefit will certainly continue to be the same over the life of the plan.

Depending on the supplier, mortgage life insurance coverage. A home mortgage protection policy that's bundled right into your mortgage is also more restrictive, as you can not select to terminate your protection if it ends up being unnecessary.

Insurance On Home Loan Amount

You would certainly have to continue paying for an unnecessary advantage. Term and mortgage life insurance policy policies have several resemblances, yet especially if you're healthy and balanced and a nonsmoker.

If there are more important costs at the time of your fatality or your family decides not to maintain your home, they can use the full term-life insurance coverage payment however they choose. Mortgage life insurance policy quotes are a lot more expensive for healthy and balanced property owners, because the majority of policies do not require you to obtain a medical examination.

Latest Posts

Difference Between Life Insurance And Funeral Plan

Top Final Expense Life Insurance Companies

Funeral Advantage Rates