All Categories

Featured

Table of Contents

Keeping all of these phrases and insurance kinds right can be a headache. The adhering to table places them side-by-side so you can promptly differentiate among them if you obtain puzzled. One more insurance protection kind that can settle your home mortgage if you die is a standard life insurance policy

A remains in area for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term. A provides insurance coverage for your entire life span and pays when you pass away. Rather of paying your home mortgage lending institution directly the way home mortgage defense insurance does, common life insurance policy plans go to the beneficiaries you choose, that can after that pick to pay off the home mortgage.

One common regulation of thumb is to go for a life insurance policy policy that will certainly pay as much as 10 times the insurance holder's wage amount. You may pick to utilize something like the Penny method, which adds a household's financial obligation, revenue, mortgage and education and learning costs to compute just how much life insurance policy is needed.

It's likewise worth keeping in mind that there are age-related restrictions and thresholds enforced by virtually all insurance providers, who often won't give older purchasers as numerous choices, will charge them more or may reject them outright.

Below's just how home loan defense insurance policy gauges up against standard life insurance policy. If you're able to qualify for term life insurance, you need to avoid mortgage security insurance (MPI).

In those situations, MPI can provide excellent peace of mind. Every mortgage security alternative will certainly have numerous regulations, regulations, advantage choices and downsides that need to be considered very carefully versus your precise scenario.

Time Limit On Mortgage Ppi Claims

A life insurance policy can help pay off your home's mortgage if you were to pass away. It is among several manner ins which life insurance policy may help protect your enjoyed ones and their economic future. Among the most effective ways to factor your mortgage into your life insurance need is to talk with your insurance policy representative.

Instead of a one-size-fits-all life insurance policy plan, American Domesticity Insurance coverage Company uses plans that can be created especially to satisfy your family's demands. Right here are some of your choices: A term life insurance policy plan. pmi claims is energetic for a specific quantity of time and commonly offers a bigger quantity of protection at a reduced price than a long-term policy

Instead than only covering an established number of years, it can cover you for your entire life. It also has living advantages, such as cash worth accumulation. * American Family Members Life Insurance Firm supplies various life insurance plans.

Your representative is a terrific source to answer your inquiries. They may likewise be able to assist you discover spaces in your life insurance policy coverage or brand-new methods to save money on your other insurance coverage. ***Yes. A life insurance policy recipient can pick to utilize the death benefit for anything - loan protection life and disability insurance. It's a fantastic way to aid guard the economic future of your family members if you were to pass away.

Life insurance coverage is one method of aiding your family members in paying off a home loan if you were to pass away prior to the home loan is completely repaid. Life insurance earnings might be made use of to help pay off a mortgage, however it is not the very same as mortgage insurance coverage that you may be required to have as a condition of a loan.

Mortgageprotect Insurance

Life insurance policy may help guarantee your residence stays in your household by providing a death benefit that might assist pay for a home loan or make important purchases if you were to pass away. Contact your American Family Insurance policy agent to review which life insurance policy plan best fits your requirements. This is a brief description of coverage and undergoes policy and/or biker terms, which may differ by state.

Words lifetime, lifelong and irreversible go through policy terms. * Any kind of financings extracted from your life insurance policy will certainly accrue interest. pmi companies list. Any type of exceptional lending balance (loan plus rate of interest) will certainly be subtracted from the death advantage at the time of case or from the money value at the time of abandonment

** Subject to plan terms. ***Discounts may differ by state and firm underwriting the vehicle or home owners plan. Discounts may not relate to all protections on a vehicle or house owners policy. Price cuts do not put on the life plan. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage protection insurance (MPI) is a different type of guard that could be useful if you're unable to settle your home mortgage. Mortgage security insurance policy is an insurance policy that pays off the remainder of your mortgage if you pass away or if you end up being disabled and can not function.

Both PMI and MIP are needed insurance coverages. The quantity you'll pay for home loan defense insurance coverage depends on a selection of variables, consisting of the insurer and the existing balance of your mortgage.

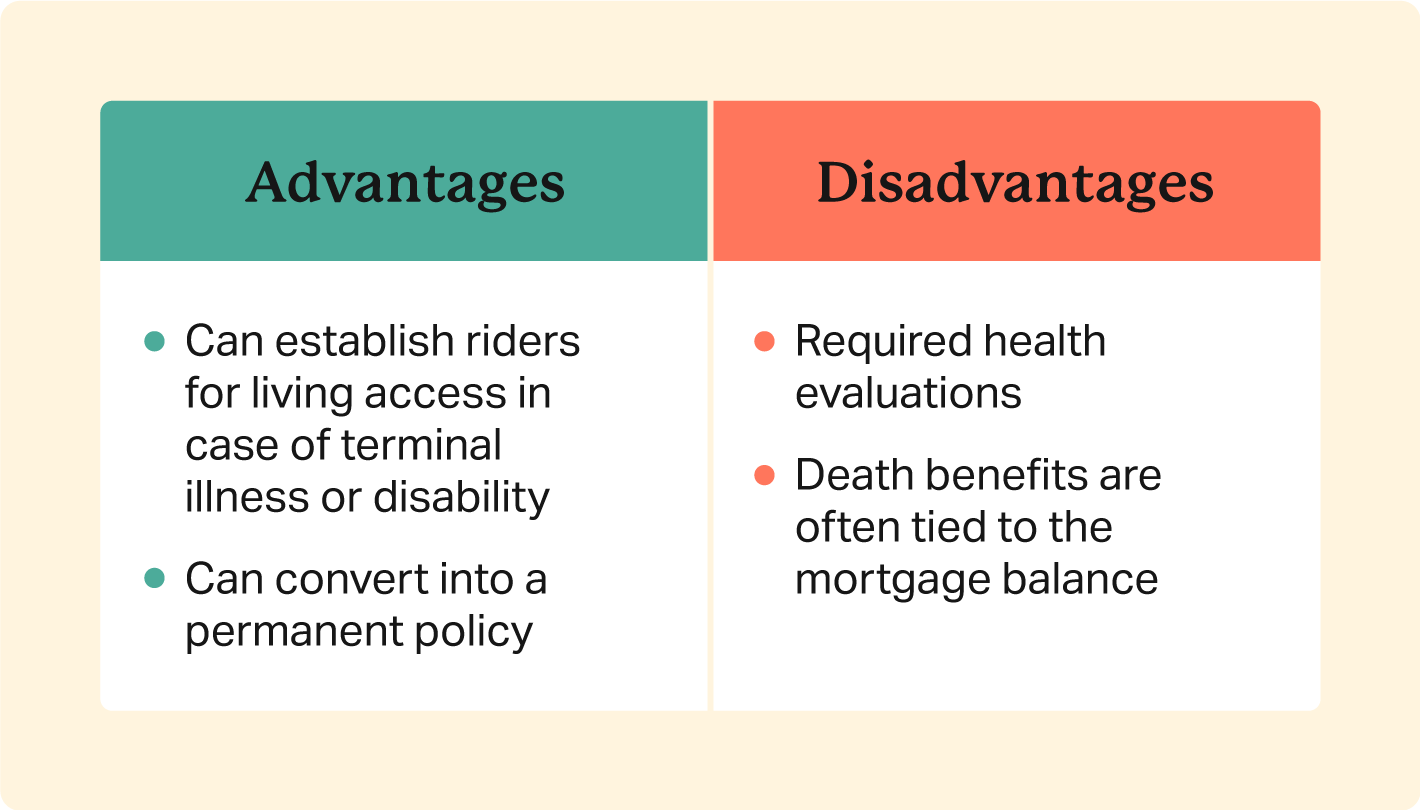

Still, there are advantages and disadvantages: A lot of MPI policies are provided on a "guaranteed approval" basis. That can be useful if you have a wellness condition and pay high rates for life insurance policy or battle to obtain coverage. mortgage risk insurance. An MPI policy can provide you and your family members with a complacency

Compare Mortgage Payment Protection

It can additionally be practical for individuals who do not qualify for or can't afford a conventional life insurance policy plan. You can select whether you need home loan defense insurance and for for how long you require it. The terms typically vary from 10 to thirty years. You might desire your home loan security insurance term to be enclose length to how much time you have left to pay off your home loan You can terminate a home mortgage defense insurance plan.

Latest Posts

Difference Between Life Insurance And Funeral Plan

Top Final Expense Life Insurance Companies

Funeral Advantage Rates