All Categories

Featured

Table of Contents

That commonly makes them an extra inexpensive alternative for life insurance coverage. Some term plans may not keep the costs and survivor benefit the very same with time. What is level term life insurance. You do not wish to erroneously think you're buying degree term insurance coverage and then have your fatality advantage modification later. Several people get life insurance policy coverage to help monetarily shield their liked ones in instance of their unexpected death.

Or you may have the alternative to transform your existing term coverage right into an irreversible plan that lasts the rest of your life. Various life insurance coverage plans have prospective advantages and disadvantages, so it's important to recognize each before you choose to acquire a policy.

As long as you pay the costs, your recipients will certainly obtain the survivor benefit if you die while covered. That claimed, it is very important to keep in mind that the majority of policies are contestable for 2 years which indicates coverage could be rescinded on death, must a misstatement be located in the application. Policies that are not contestable commonly have a rated death advantage.

How Does Level Term Life Insurance Policy Benefit Families?

Premiums are usually less than entire life plans. With a degree term plan, you can select your insurance coverage quantity and the policy length. You're not locked right into an agreement for the remainder of your life. Throughout your plan, you never ever have to bother with the premium or fatality benefit quantities changing.

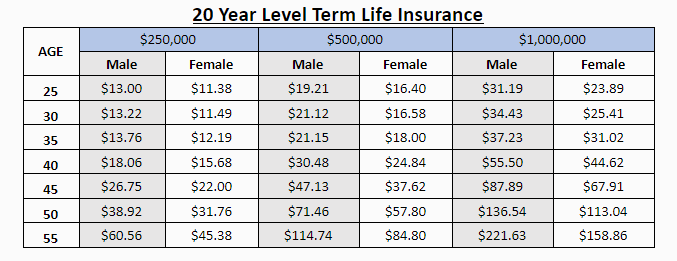

And you can't squander your policy throughout its term, so you will not receive any type of monetary advantage from your past insurance coverage. As with various other sorts of life insurance policy, the expense of a degree term plan relies on your age, protection requirements, employment, lifestyle and wellness. Generally, you'll discover a lot more budget-friendly insurance coverage if you're younger, healthier and much less risky to guarantee.

Given that degree term premiums remain the exact same for the duration of insurance coverage, you'll recognize exactly how much you'll pay each time. Level term protection also has some adaptability, allowing you to customize your policy with additional attributes.

What is Level Premium Term Life Insurance? Quick Overview

You might have to fulfill details problems and qualifications for your insurer to enact this motorcyclist. There likewise can be an age or time restriction on the insurance coverage.

The death benefit is generally smaller, and insurance coverage usually lasts till your child turns 18 or 25. This rider may be a much more affordable method to assist guarantee your kids are covered as cyclists can usually cover several dependents at the same time. Once your kid ages out of this insurance coverage, it may be possible to transform the cyclist into a brand-new plan.

The most typical kind of irreversible life insurance policy is entire life insurance coverage, but it has some essential distinctions compared to level term protection. Here's a standard review of what to think about when contrasting term vs.

What is Annual Renewable Term Life Insurance and How Does It Work?

Whole life entire lasts for life, while term coverage lasts protection a specific period. The premiums for term life insurance policy are usually reduced than entire life coverage.

Among the highlights of level term insurance coverage is that your costs and your death benefit do not alter. With decreasing term life insurance policy, your costs remain the same; nonetheless, the survivor benefit amount obtains smaller gradually. As an example, you might have coverage that starts with a survivor benefit of $10,000, which can cover a mortgage, and after that every year, the death advantage will reduce by a collection amount or percentage.

Due to this, it's commonly a much more budget-friendly type of level term insurance coverage., however it may not be adequate life insurance for your needs.

Is Decreasing Term Life Insurance the Right Fit for You?

After deciding on a plan, finish the application. If you're authorized, sign the documentation and pay your initial costs.

Lastly, take into consideration organizing time annually to assess your plan. You may wish to upgrade your beneficiary details if you have actually had any kind of considerable life adjustments, such as a marital relationship, birth or divorce. Life insurance coverage can occasionally feel difficult. You don't have to go it alone. As you explore your choices, take into consideration reviewing your requirements, wants and concerns with a financial expert.

No, level term life insurance policy doesn't have money worth. Some life insurance policy policies have a financial investment feature that permits you to develop cash money worth with time. A part of your costs settlements is reserved and can gain rate of interest over time, which expands tax-deferred during the life of your protection.

These policies are often substantially more expensive than term protection. If you get to completion of your plan and are still to life, the insurance coverage ends. Nevertheless, you have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your insurance coverage has actually gone out, for instance, you may intend to buy a brand-new 10-year degree term life insurance plan.

Why Term Life Insurance Matters

You might be able to convert your term insurance coverage right into an entire life policy that will certainly last for the remainder of your life. Lots of sorts of degree term policies are convertible. That implies, at the end of your coverage, you can convert some or every one of your policy to whole life protection.

A degree premium term life insurance coverage plan lets you stick to your spending plan while you aid safeguard your family members. ___ Aon Insurance Policy Services is the brand name for the broker agent and program administration procedures of Affinity Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Company, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Policy Solutions Inc.; in CA, Aon Fondness Insurance Policy Services, Inc .

Latest Posts

Difference Between Life Insurance And Funeral Plan

Top Final Expense Life Insurance Companies

Funeral Advantage Rates